Table of Content

This article explains these requirements, shows you how to calculate the deduction percentage, and explains the specific expenses you can deduct from your taxes if you qualify. A common use of the home for business is using the home as a daycare facility. The next step in calculating the home business tax deduction is to apply this percentage to your allowable household expenses. You can deduct a portion of all your house expenses that directly relate to operating your business such as your utilities, telephone, and cleaning materials. Regardless of the method used to compute the deduction, you may not deduct business expenses in excess of the gross income limitation.

You can deduct all ordinary commercial insurance premiums you incur on any buildings, machinery, and equipment you use in your business. Insurance costs related to your motor vehicle must be claimed as motor vehicle expenses. When it comes to deducting business expenses for repairs and maintenance, you can’t deduct the value of your own labour. Before you use the business use of home deduction, you need to figure out what percentage of each bill you can deduct. The CRA doesn’t have a hard and fast rule for how you calculate this percentage. You must, however, use a reasonable method for the type of business you have.

Who Can Claim Business-Use-Of-Home Expenses?

Once you do, you can benefit from income tax deduction from your home expenses. Therefore, you cannot claim business-use-of-home expenses if you are also conducting business elsewhere or because you sometimes work on business matters at home. The expenses that employees can deduct are utilities (hydro and gas/ heat), as well as maintenance and repairs for the work area.

Your employer might cover your internet or phone, for example, but your company probably doesn’t pay your renter’s insurance. Before the 2018 tax year, you could claim these expenses as deductions on your taxes, but for all years after 2018, you can’t deduct these unreimbursed costs. If you run a business and hire employees that work from home, you may need to cover their expenses in lieu of the tax deduction. Only business owners – both sole proprietors and shareholders of Corporations – can deduct home expenses from their taxes as a business expense.

Can You Claim Previous Year’s Expenses?

If you are self-employed or run an unincorporated small business, you can claim a donation on your personal tax return. You need to dedicate a specific room to your office and then calculate the square footage of that office in comparison to the size of the rest of your home. If you have an incorporated business and use your phone entirely for company purposes, you can claim the entire monthly cell phone bill as an expense. If you are self-employed and use your phone for both personal and business reasons, you can expense the business portion. The business expenses that relate to the business activity in the home , but not to the use of the home itself. The space must be used as your principal place of business or for specific business purposes, like meeting clients or doing business paperwork.

This is the case if you use your home for your business or to earn income, as mentioned above. No matter what kind of business you have – in any industry – if your home is a primary place of business, you can deduct household expenses as a business expense. For more information, see Publication 587, Business Use of Your Home . You add up your maintenance costs (such as heat, electricity, cleaning materials, etc.), insurance, mortgage interest and property tax for the year and your total expenses are $20,000. To calculate business-use-of-home expenses, you must first calculate how much space your home office occupies in your home’s overall square footage.

Calculate the Business Use of Home Deduction Percentage

If you pay $1000 per month in rent, that means you can deduct $250 as a business expense. Since you only use the room for 8 hours per day, however, you can’t deduct the full $250. In this case, you should divide 8 by 24 to get .33—in other words, you only use the space as an office 33% of the time. This is the amount of rent you can deduct as a business expense each month. If you own your home, you should include property taxes and capital cost allowance. If you want, you can also deduct part of your home’s cost as depreciation.

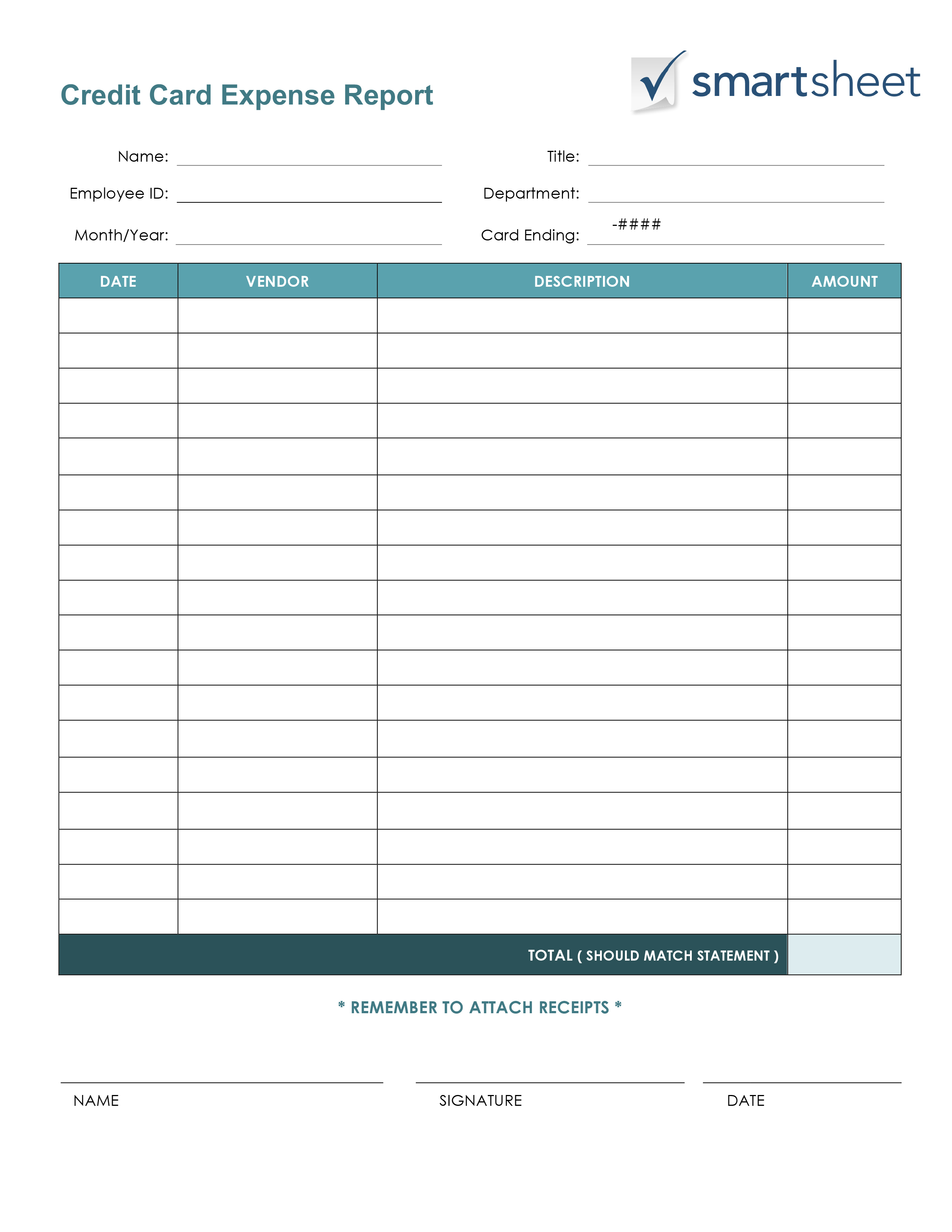

These expenses might include furniture, painting, repairs, or upkeep of your home office. These expenses are fully deductible, but the area must be dedicated exclusively to your business. To claim home expenses for business use, you simply fill in Part 7 of the form and file it to the CRA. You must keep record of each expense you intend to deduct with invoices and receipts.

In addition to your other business expenses, the IRS allows you to deduct and indirect expenses that are related to the "business use of your home." If you opt for this simpler method, you will deduct any allowable homeowner expenses on your personal return. Using the standard deduction also means you may not deduct a depreciation expense. Depending on your situation and expenses, the standard deduction may or may not make sense for you.

Let’s say your office is 100 square feet and your home is 2000 square feet. If you go out for a meal during your lunch hour, you can’t claim this as a business expense because it was not used to generate income. Like the expense of commuting to the office, lunches just come out of your own pocket.

Expert advice and resources for today’s accounting professionals. Prior to joining the firm in 2004, Jody was in the private sector where he held senior financial and management positions including General Manager, Chief Financial Officer and Controller. He has experience across industries, which gives him a deep understanding of business. Jody H. Chesnov, CPA, Managing Partner of Rosenberg Chesnov,has been with the firm since 2004. After a career of public accounting and general management, Jody knows the value of good financials.

What’s also important is properly logging your work hours so that when tax time comes, you aren’t guessing and left feeling unsure. It is safe to assume you are logging work hours for your company anyway, so as long as you keep up to date on these entries and use these numbers for your taxes, everything should be fine. Multiply your home office expenses ($20,000) by 15%, for kitchen expense of $3,000. You use your kitchen 8 hours x 5 days a week, for a total of 40 hours out of 168 . Now lets say your kitchen is 300 sq ft, which is 15% of your home.

No comments:

Post a Comment